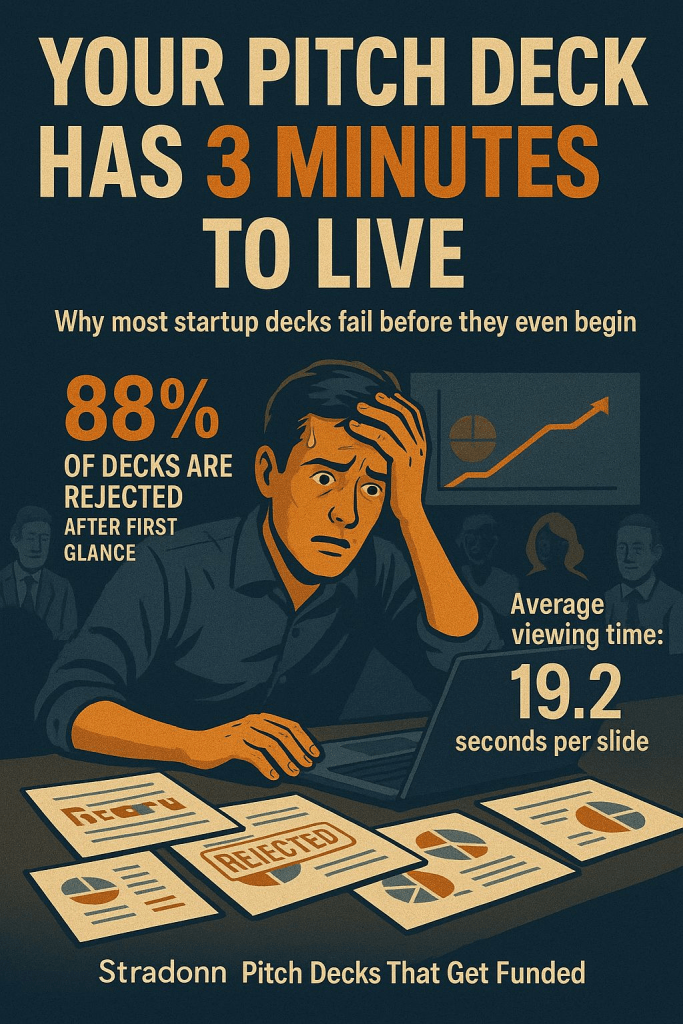

That’s all the time your pitch deck gets before investors move on.

A Dropbox DocSend study analysed 200+ startup decks. The findings?

- Only 12% were read in full

- Average time spent per slide: 19.2 seconds

- Most time spent on: Company Purpose, Business Model, and Financials

Founders Obsess Over Storytelling.

But Investors Are Scanning for Clarity, Traction, and Proof.

Here’s what 80% of VCs look for—and how to make every second count.

1. Nail Your One-Liner

- The most viewed slide is your Company Purpose.

- Yet most founders get it wrong—either too vague or too long.

- You need a sharp, specific sentence.

Example:

“We help SMBs cut logistics costs by 30% using AI-based routing.”

One line. Clear ROI. Zero guesswork.

2. Competition Slides Shouldn’t Need Explaining

- VCs spent 51% more time on the Competition slide in successful decks.

- What works: a quadrant chart or a simple table.

- What doesn’t: dense text or a “we have no competitors” claim.

- If they can’t quickly see why you win, you don’t.

3. The Financials Slide Isn’t Optional

- Funded decks? 100% had one.

- Non-funded? Only 58% did.

VCs expect:

- CAC vs LTV

- Burn and runway

- Revenue forecast (top-down and bottom-up)

Don’t bury the metrics. Highlight what matters most.

4. Visuals = Trust

- Clarity drives confidence.

- Inconsistent fonts or cluttered charts? It’s a red flag.

- Great decks have whitespace, data hierarchy, and brand alignment.

- Design doesn’t just make it look better.

- It makes it believable.

5. Traction Wins Attention

In one case, a founder raised $10M with a single graph showing 12 months of user growth.

That traction slide?

- Held attention longer than any other.

- Charts > paragraphs

- Progress > promises

6. Turn Your Product into a Story

According to VCs, they’re 20x more likely to remember a pitch with a customer success narrative.

Frame your slides around:

- A real-world problem

- A clear before/after

- A user who benefited

Features tell. Stories sell.

7. TAM/SAM/SOM Done Right = Follow-Up

- Big numbers don’t impress. Credible breakdowns do.

- Decks that mapped out the market got 2x the meetings.

- No fluff. Just logic, visuals, and citations.

- Make the market feel big and believable.

8. There’s a Structure That Just Works

The top decks follow this 10-slide flow:

- Purpose

- Problem

- Solution

- Why Now

- Product

- Market

- Business Model

- Traction

- Team

- Financials

It’s not just a format—it’s psychology.

Every slide answers an investor’s next question.

At Stradonn Consulting, We Don’t Just Design Decks. We Craft Investor Magnets.

We help founders:

- Build narratives that flow

- Turn spreadsheets into dashboards

- Visualize traction with clarity

- Create financials that build trust

Pitch decks, board reports, dashboards—if it’s investor-facing, we elevate it. Contact Us here or Fill the form below to get started:

Leave a comment